Sba commercial mortgage calculator

Government-backed loans such as SBA loans from the Small Business Administration or USDA loans from the Department of Agriculture and conventional commercial mortgages will generally offer the most competitive. You can get a business mortgage using the SBA 7a loan for a wide range of industries and property types.

Choosing The Right Sba Loan For Your Business Bfc Business Finance Capital

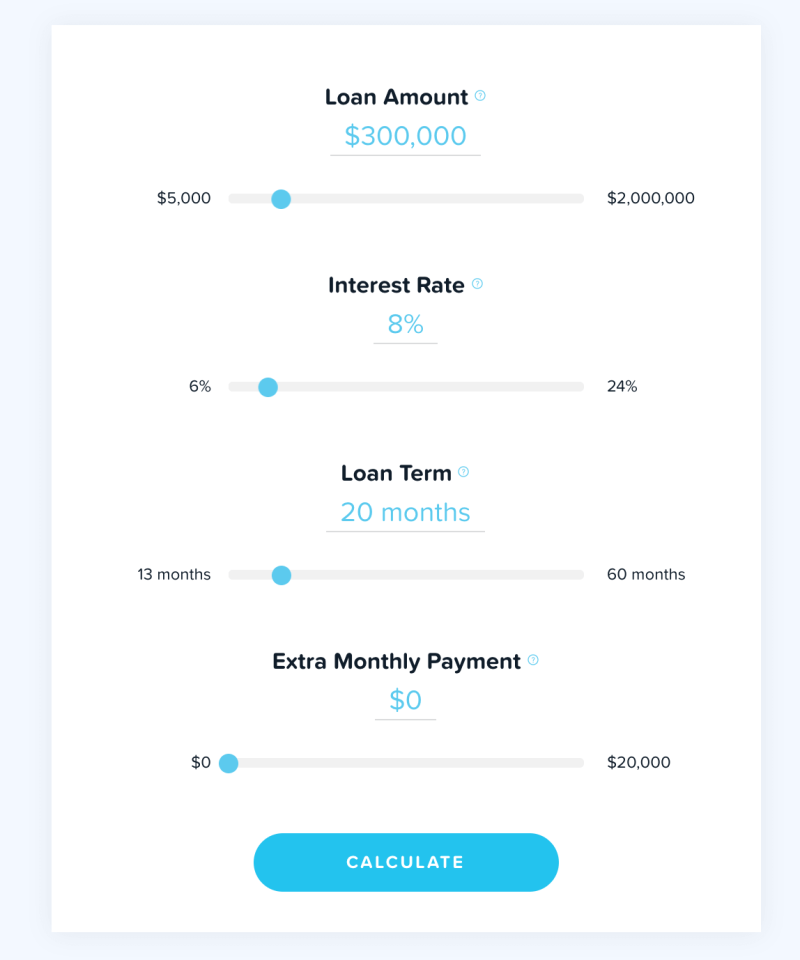

Thats why we created our business loan calculator.

. The existing home mortgage and any liens on the property are paid off and replaced with a new mortgage. Prerequisites for Writing Loan Request Letters. 30-year mortgage calculator can help you determine which option is right for.

Typically the term or length of a commercial mortgage can be anywhere from 1-10 years with limited exceptions for longer terms on self-amortizing loans such as SBA loans up to 25 years insurance or Fannie Mae loans up to 30 years or FHA loans up to 35 years for refinance or 40 years for construction to permanent financing. This calculator will compute the payment amount for a commercial property giving payment amounts for P I Interest-Only and Balloon repayment methods -- along with a monthly amortization schedule. SBA loan rates as of July 2022.

With this option the total amount you pay over the life of the loan will usually be higher. Enter a few details in the fields below and well show you examples of different loan terms monthly payments and annual percentage rates APR. Furthermore you can obtain a loan with an online lender or a microlender.

Conforming Fixed-Rate estimated monthly payment and APR example. To be eligible for an SBA 7a loan a business must operate for profit in the US. The commercial mortgage appraisal will take into to consideration a lot more than just the property value.

Borrowers also must have a reasonable amount of their own equity to invest in the business. Average commercial real estate loan rates by loan type. You must also get an SBA 504 loan from a Certified Development Company or CDC rather than from a bank or traditional lending institution.

Use our financing payment calculator to estimate your monthly payment for a new or used vehicle you buy at a dealership. This type of mortgage is structured with 2 loans. HUD 223f HUD 223a7 SBA Express Loans SBA 504 Loans Self Storage Loan Industrial Property Loan and Opportunity Zones Help.

Commercial loan rates are currently in between 450 and 1627 depending on the loan product. Heres a list of some industries that regularly. While a loan request letter may be needed for bank and SBA loans it wont be enough for approval unless its supported by a sound credit situation and solid financial planningFor your request to be persuasive to lenders you should do 2 things before preparing your business request letter and loan application package.

For conventional commercial mortgages the current rates are between 527 and 842. A cash-out refinance comes with closing costs comparable to your first mortgage. Term loans and lines of credit.

Up to 500000 Market prime rate plus 45 to 65. FAQs about refinancing commercial real estate. In 2020 the average interest rate on a commercial mortgage refinance loan ranged between 3 and 12.

Retail stores make up roughly 16 of existing commercial real estate. The SBA 7a is also the least expensive financing available. Just enter your loan amount and interest rate and our calculator will do the rest.

Fixed-rate loans are typically available for 10- 15- 20- or 30-year loan terms but other terms may be available. SBA Express Loan Rates. Its geared toward borrowers who utilize over 50 percent of their existing commercial property.

Commercial mortgage appraisals may range from 2000 to 4000 but charges will vary based on location and other factors. A 30-year mortgage generally offers lower monthly payments. Use this FHA mortgage calculator to get an estimate.

A refinance with cash out is an alternative to a home equity loan also known as a second mortgage because its a lien on your home like your existing mortgage. Our friendly professional mortgage experts take time to understand your needs to help you find the right fit and our simple application process gets. One part of the loan must be financed with a Certified Development Company CDC which accounts for 40 percent of the loan amount.

This means youll be able to pay the loan off faster and pay less interest over the life of the loan. A fixed-rate loan offers a consistent rate and monthly mortgage payment over the life of the loan. Calculate monthly auto payments.

An Express loan is a type of 7a loan that offers borrowers faster approval times than other SBA loans24 to 36 hours. Most commercial mortgage amounts range between 150000 and 5000000. An FHA loan is a government-backed conforming loan insured by the Federal Housing Administration.

Weve helped more than 43000 of our neighbors find their way home. Empower Federal Credit Union is the mortgage lender offering a variety of products to help you purchase a home or refinance your existing mortgage with some of the most competitive rates in NY. Use our commercial mortgage calculator with attached amortization schedule to determine monthly payments.

Because interest rates and terms can vary depending on whether the property is an investment property or owner-occupied we have a commercial mortgage calculator for each scenario to give you the most accurate estimates possible. FHA loans have lower credit and down payment requirements for qualified homebuyers. SBA 7a Loan Calculator.

Enter different loan amounts interest rates and terms in years to get a clearer picture of how much youll actually have to pay. A small business loan like the SBA 7a loan can be exactly the nudge you need to grow your organization -- but no matter how you spin it borrowing for your business is a big decision. Please note that these non-SBA and non-bank lenders often have elevated APRs so keep that in mind when applying and use realistic APRs in this business loan calculator.

Another popular SBA commercial mortgage is the SBA 504 loan. SBA 7a Commercial Real Estate Loan. How are commercial refinance rates.

It will also include things such as. Additionally it is useful for investors that are in the process of deciding whether or not to refinance a commercial property they already own. This fixed-rate mortgage calculator provides customized information based on the information you provide.

The SBA provides loans to small businesses of all sizes. A 225000 loan amount with a 30-yea r term at an interest rate of 3875 with a down-payment of 20 would result in an estimated principal and interest monthly payment of over the full term of the loan with an Annual Percentage Rate APR of 3946. Should you be turned down for a traditional commercial mortgage a government-backed SBA Small Business Administration loan would be a viable next optionin fact being rejected for a standard bank loan is one of the prerequisites for an SBA loanPlus the interest rates are typically lower with SBA loans as are the credit score requirements but the.

Depending on the type of loan you choose interest rates could be as low as 2231. Loan types Loan amounts Rates Repayment terms Loan uses. For instance the minimum required down payment for an FHA loan is only 35 of the purchase price.

SBA 7a loans could help with numerous licensing fees technology upgrades payroll and benefits marketing and social media promotion upgraded inventory renovation and even expansion.

Sba Loans Up To 10 Million Dollars Government Backed Kapitus

Business Loan Calculators Estimate Your Payments Lendio

Commercial Loan Calculators Monthly Payment Refinance Dscr Cap Rate Noi Calculators

Easy Commercial Mortgage Payment Calculator Lendio

Sba 504 Loan Calculator Free Loan Calculator Tmc Financing

Sba Loan Calculator Estimate Payments Lendingtree

Commercial Mortgage Calculator Best Business Loans Cheddar Capital

Business Loan Calculator Small Business Trends

Small Business Loan Calculator

Sba Loan Calculator Estimate Payments Lendingtree

More Economic Relief For Sba Borrowers The Sba Will Pay For Your Loan Payments For Up To Five Months Frost Brown Todd Full Service Law Firm

Sba 504 Vs 7a Loan Comparison Sba Commercial Real Estate Loan

Now May Be Time For Self Storage Borrowers To Refinance Sba 7 A Loan Inside Self Storage

Can I Sell My Business If I Have An Sba Loan Viking Mergers

Commercial Mortgage Calculator Monthly Payment Calculator

.png)

Business Loan Calculator Find The Best Loan For Your Small Business

What You Need To Know About An Sba Loan Ondeck